Insurance Claim Process! Step by Step Guide to Hassle-Free Settlements

Insurance offers peace of mind by providing financial protection against unexpected losses. However, the real test of an insurance policy comes when you need to file a claim. Whether it’s a car accident, medical emergency, property damage, or life insurance benefit, understanding the claim process is essential to ensure timely and successful compensation.

In this article, we’ll take you through the insurance claim process step by step, explain common requirements, and share tips to make the experience smoother and stress-free.

1. Understanding What an Insurance Claim Is

An insurance claim is a formal request you make to your insurance company to receive payment or compensation for a covered loss. Once you submit a claim, the insurer evaluates it based on the terms and conditions of your policy.

For example, if your car is damaged in an accident, you file a claim with your auto insurer. The company then reviews the case, assesses the damage, and compensates you according to your policy coverage.

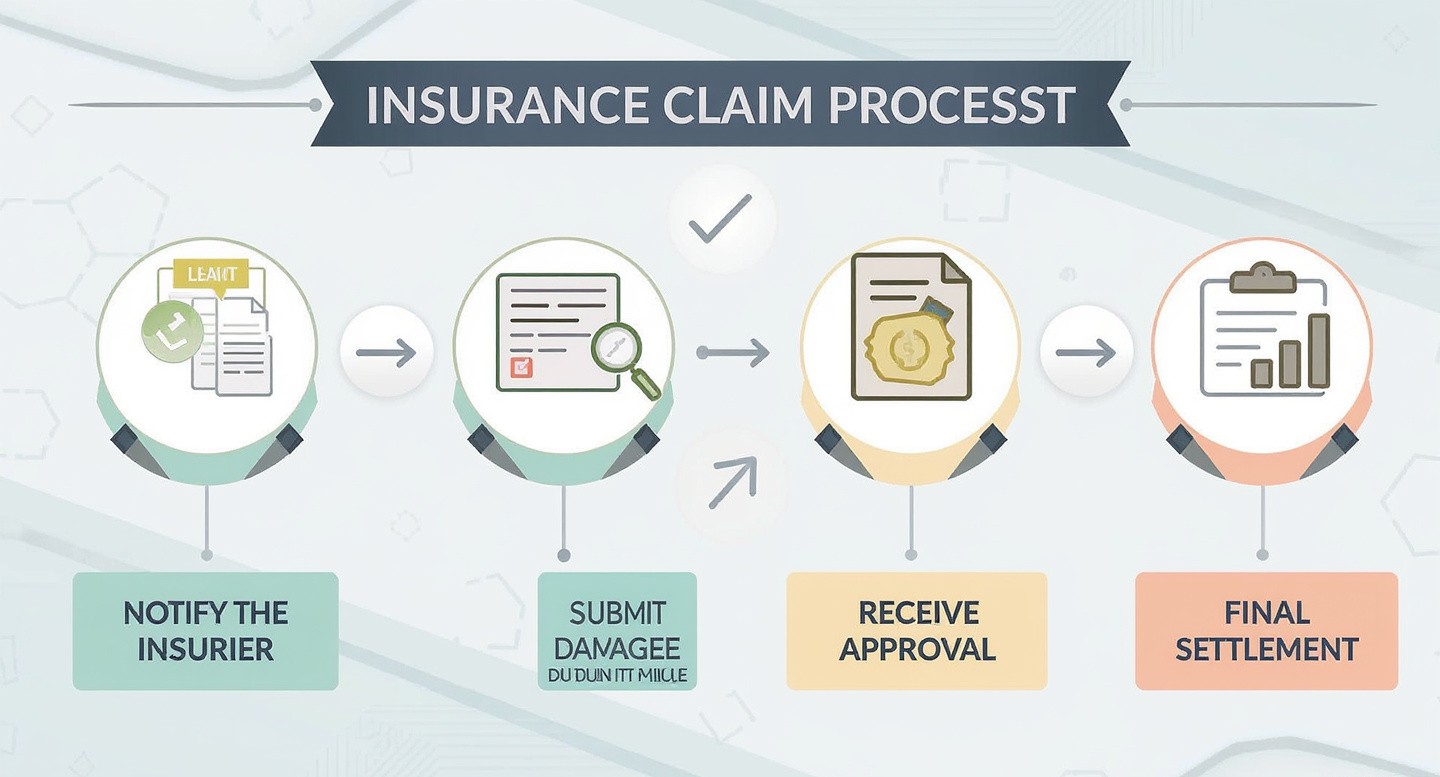

Step 1: Notify the Insurer Immediately

The first and most crucial step in the claim process is prompt notification. As soon as an incident occurs—such as an accident, hospitalization, theft, or property loss—you must inform your insurance provider.

Most companies have a time limit for reporting claims, usually within 24 to 48 hours. Delaying notification can lead to complications or even denial of the claim.

You can contact your insurer through:

- Customer helpline

- Mobile app or website portal

- Nearest branch office

- Insurance agent or broker

Keep your policy number and personal identification handy when reporting the incident.

Step 2: Fill Out the Claim Form

After reporting the incident, the insurer will provide you with a claim form. This form is an official document that contains details about the event, policy information, and your request for compensation.

You can usually fill it out online or submit a paper version. Make sure to provide accurate and complete information — incorrect or missing details may delay claim processing.

Step 3: Submit Required Documents

Each type of insurance claim requires supporting documentation to verify the loss. These documents help the insurer assess the validity of your claim.

Some common examples include:

- Health Insurance: Medical reports, hospital bills, prescriptions.

- Auto Insurance: FIR (if applicable), accident photos, repair bills, driving license.

- Home Insurance: Proof of ownership, photographs of damage, repair estimates.

- Life Insurance: Death certificate, ID proof of nominee, policy documents.

Always check the specific document checklist provided by your insurer to avoid unnecessary delays.

Step 4: Claim Assessment and Verification

Once your documents are submitted, the insurer begins the verification process. This involves reviewing your policy, assessing the damage, and confirming whether the claim falls within the policy’s coverage terms.

For certain claims, especially property or vehicle-related ones, an insurance surveyor or adjuster may be sent to inspect the loss and prepare a detailed report.

During this stage, the insurer may contact you for clarifications or additional documents, so it’s important to stay responsive.

Step 5: Approval or Rejection of Claim

After verification, the insurer will decide whether to approve or reject the claim.

- If approved: You’ll receive the compensation or service as per your policy terms.

- If rejected: The insurer must provide a valid reason, such as policy exclusion, incomplete documentation, or false information.

In case of rejection, you can appeal by submitting a written request for review along with any missing or corrected details.

Step 6: Settlement and Payment

Once approved, the claim moves to the settlement stage. The insurer either:

- Reimburses your expenses directly into your bank account, or

- Pays the service provider (e.g., hospital, garage) through a cashless settlement.

The timeline for settlement depends on the claim type and complexity but usually takes a few days to a few weeks after approval.

Step 7: Closing the Claim

After payment is made, the insurer issues a claim settlement letter confirming that the case is closed. Keep all correspondence, receipts, and documents safely they may be needed for future reference or tax purposes.

Smooth Claim Process

- Read your policy carefully before filing a claim.

- Keep copies of all documents and receipts.

- Always report losses honestly; false claims can lead to rejection and blacklisting.

- Use your insurer’s digital tools (apps or portals) for faster tracking and updates.

- Follow up regularly until the claim is fully settled.