The Evolution of Insurance! From Ancient Times to the Modern World

Insurance, as we know it today, is a highly organized and regulated industry that protects individuals and businesses from financial loss. However, this concept did not emerge overnight. The foundation of insurance was laid thousands of years ago when humans first began to trade, travel, and protect their possessions from risk. Over centuries, insurance evolved from informal community practices into a sophisticated global financial system.

1. The Birth of Insurance in Ancient Civilizations

The earliest evidence of insurance-like practices dates back to around 1750 BCE in Babylon, where King Hammurabi’s Code included laws to protect traders. Under this system, merchants could pay an additional fee to a lender, who would cancel their loan if the shipment was lost or stolen. This was one of the first formal risk-sharing mechanisms in history.

Similarly, ancient Chinese merchants developed a method to spread risk by dividing their goods among multiple ships. If one vessel sank, no merchant would lose everything. Greek and Roman traders also practiced “bottomry contracts,” where shipowners took loans that would be forgiven if their ships were destroyed during voyages.

2. The Rise of Marine and Merchant Insurance

As trade expanded across continents, marine insurance became vital. During the Middle Ages, Italian merchants in cities like Genoa and Venice pioneered more advanced insurance contracts to protect against shipwrecks and piracy.

By the 14th century, the first recorded insurance contract was signed in Genoa in 1347, marking the transition from informal to formalized agreements.

This period also saw the establishment of early insurers and brokers, as merchants realized the importance of organized risk management in long-distance trade. These marine policies laid the groundwork for modern insurance contracts.

3. Medieval Guilds and Mutual Protection Systems

During medieval Europe, craft guilds played a key role in the development of mutual insurance systems. Guild members paid regular fees into a shared fund to support families affected by illness, death, or accidents. This system represented the beginning of life and social insurance concepts protecting individuals rather than just property.

Similar mutual aid systems existed in other regions as well. In Islamic societies, the concept of “Takaful” emerged, promoting cooperative risk-sharing in line with Sharia principles. These community-based systems highlighted the human desire to collectively safeguard against misfortune.

4. The Birth of Modern Insurance Lloyd’s of London

The 17th century marked a turning point in the evolution of insurance. In London, merchants, sailors, and shipowners gathered at Edward Lloyd’s Coffee House to discuss shipping risks and share information. Over time, this meeting place evolved into Lloyd’s of London, the world’s most famous insurance market.

By the 18th century, specialized insurance companies began to form, offering not only marine but also fire and life insurance. The Great Fire of London (1666) accelerated the demand for property insurance, leading to the establishment of The Fire Office and Sun Fire Office, early examples of organized insurers.

5. Expansion into Life and Health Insurance

With the growth of science and mathematics in the 18th and 19th centuries, insurance became more data-driven. Actuaries began using mortality tables to calculate life expectancy, allowing insurers to offer life insurance policies with predictable costs.

Health insurance also began to develop during this period, particularly as industrialization exposed workers to new risks. Employers and governments started implementing systems to protect laborers, setting the stage for modern health and social insurance programs.

6. The Industrial Revolution and Policy Growth

The Industrial Revolution transformed insurance into a large-scale industry. With factories, railways, and urban development, the need to protect property, workers, and goods skyrocketed. New types of insurance emerged including accident, liability, and workers’ compensation coverage.

By the early 20th century, governments began introducing national insurance schemes to provide social security and medical benefits, reflecting a shift from private protection to public welfare.

7. Digital Age Tech-Driven Insurance Models

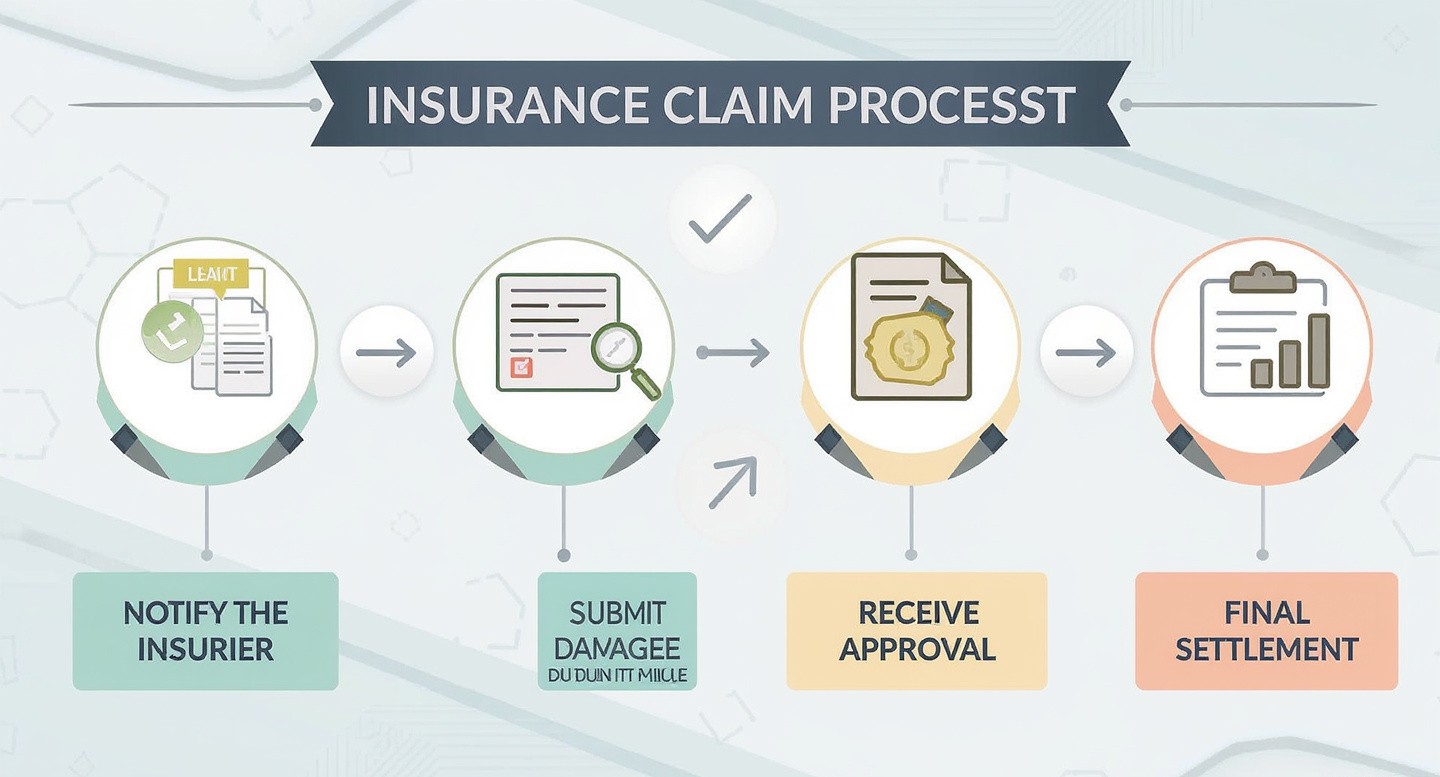

In the 21st century, insurance has entered the digital age. Today’s insurers rely on artificial intelligence (AI), big data, and machine learning to assess risk, process claims, and personalize premiums. Online platforms and InsurTech companies are redefining how people buy and manage policies.

Customers can now compare, purchase, and claim insurance entirely online a far cry from the days of handwritten contracts in ancient ports.

8. The Future of Insurance

Looking ahead, the insurance industry is expected to become even more automated and data-driven. Blockchain, IoT devices, and predictive analytics will enhance transparency and efficiency. Yet, the core principle remains unchanged sharing risk to protect individuals and communities from loss.