Why Insurance is Not a Luxury but a Necessity

Many people think of insurance as an extra expense that can be avoided, especially if they are healthy, young, or financially stable. But the truth is, insurance is not a luxury—it is a necessity. Life is unpredictable, and unexpected events such as accidents, illnesses, natural disasters, or sudden financial crises can happen to anyone. Without insurance, these situations can lead to severe financial hardship.

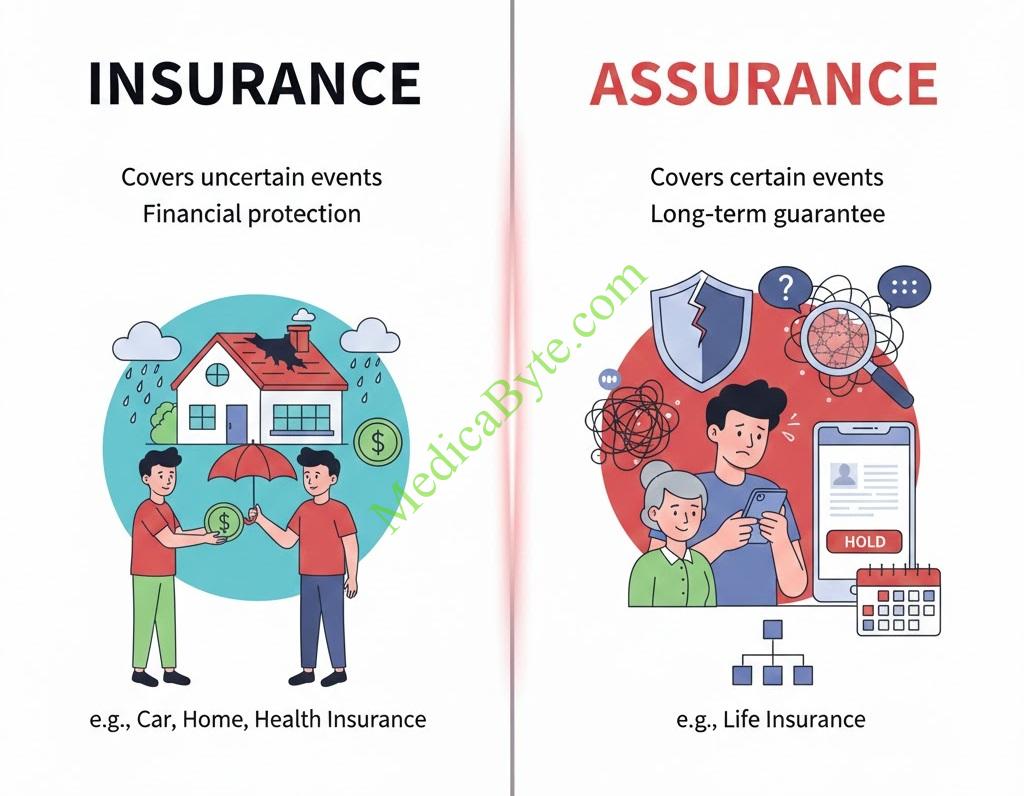

Insurance as a Shield Against Risks

Insurance works as a safety net that protects individuals, families, and businesses from unexpected losses. By paying a small premium regularly, you ensure that in the event of an emergency, you won’t have to bear the financial burden alone.

For example:

- Health insurance protects you from high medical bills.

- Car insurance saves you from sudden repair costs after accidents.

- Life insurance provides your family with financial stability if something happens to you.

- Business insurance prevents companies from collapsing after a crisis.

Why Insurance is Essential

- Protects Financial Stability

Without insurance, one accident or medical emergency could drain your savings. Insurance helps maintain financial stability by covering major expenses. - Secures Your Family’s Future

Life insurance ensures your loved ones won’t face financial struggles in your absence. It covers education, daily needs, and long-term security. - Affordable Risk Management

Paying small premiums is far more affordable than covering massive expenses during emergencies. It’s better to be prepared than to face sudden financial shocks. - Encourages Long-Term Planning

Some policies combine protection with savings or investment, helping you plan for retirement, children’s education, or wealth building. - Mandatory in Many Cases

In many countries, car insurance, employee health coverage, and business liability insurance are legally required. This shows how essential insurance is to both individuals and society.

Common Misconception: “Insurance is a Waste of Money”

Some people believe that if they never use their policy, their premiums go to waste. But insurance is not about losing money—it’s about managing risk. Just like a safety belt, you may not always need it, but when you do, it can save your financial life.

Coda

Insurance is not a privilege for the wealthy—it is a necessity for everyone. From protecting your health and family to securing your assets and business, insurance ensures peace of mind in an uncertain world.

Remember: insurance is not about if you will need it—it’s about when you will need it. Don’t wait for an emergency to realize its importance.