Why People Avoid Buying Insurance

Why People Avoid Buying Insurance

Insurance is designed to provide financial protection and peace of mind. Yet, despite its importance, many people delay or completely avoid buying insurance. Whether it’s health, life, disability, or property coverage, the hesitation is common across countries and income levels.

Understanding why people avoid insurance can help individuals make better financial decisions — and avoid costly mistakes later.

1️⃣ “It Won’t Happen to Me” Mindset

One of the biggest reasons people avoid insurance is optimism bias. Many believe:

- They won’t get seriously sick

- They won’t face accidents

- Their house won’t catch fire

- They won’t lose their job

This false sense of security leads to underestimating risks. Unfortunately, emergencies are unpredictable, and when they happen, the financial impact can be devastating.

2️⃣ Cost Concerns

Some people see insurance as an unnecessary expense rather than financial protection.

Common thoughts include:

- “Premiums are too expensive.”

- “I’d rather invest that money elsewhere.”

- “I’m young and healthy — I don’t need it yet.”

While premiums may feel like a burden, they are usually far smaller than the potential financial loss from an uncovered emergency.

3️⃣ Lack of Awareness

Many individuals simply do not understand:

- How insurance works

- What coverage they need

- The benefits of different policies

Complex policy language and technical terms can discourage buyers. Without proper knowledge, people postpone the decision.

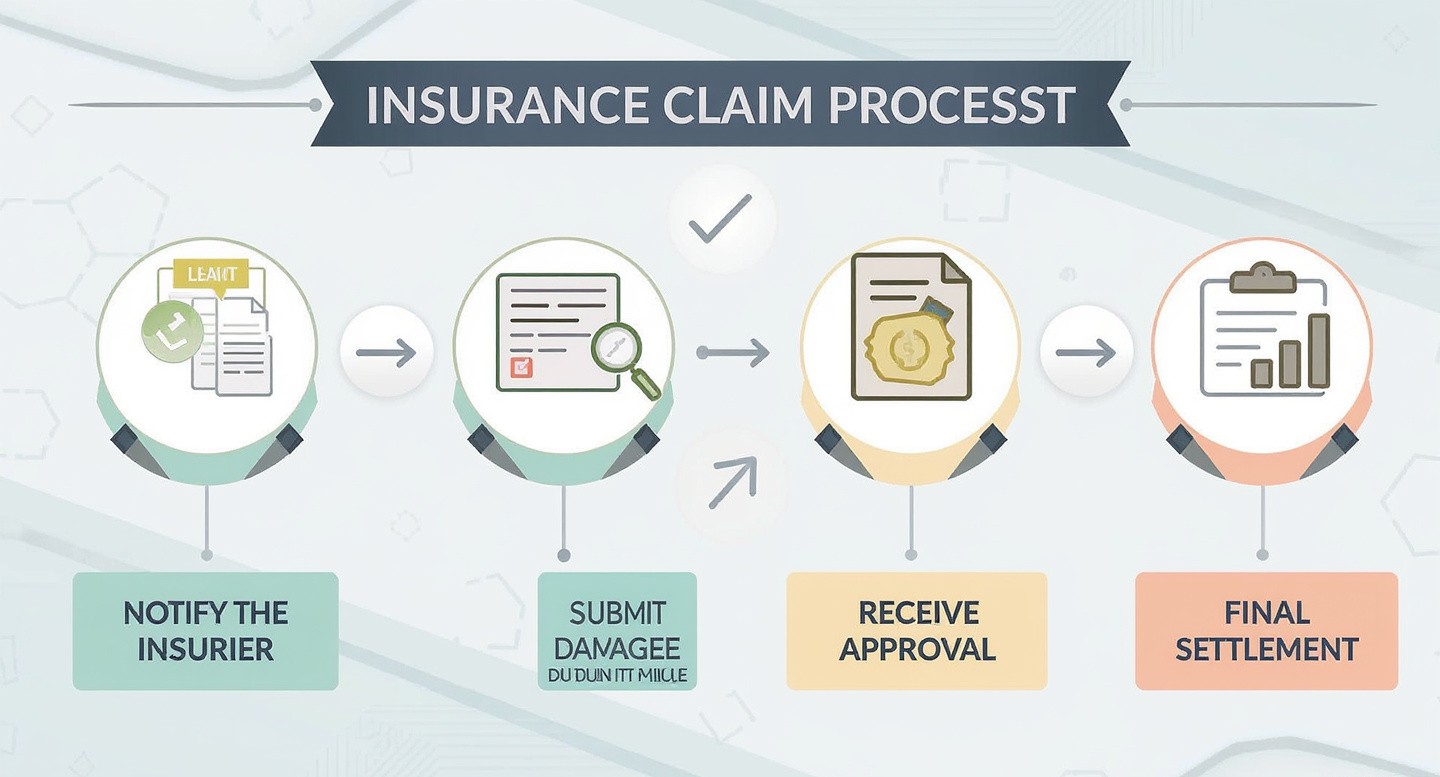

4️⃣ Mistrust of Insurance Companies

Some avoid insurance because they fear:

- Claims will be rejected

- Hidden clauses exist

- Companies delay payments

Negative stories or bad past experiences can damage trust. While not all insurers are unreliable, lack of transparency can create hesitation.

5️⃣ Procrastination

Insurance is often seen as something to buy “later.”

People delay purchasing because:

- It doesn’t feel urgent

- There is no immediate reward

- Paperwork seems time-consuming

Unfortunately, waiting too long can result in:

- Higher premiums

- Medical exclusions

- Loss of eligibility

6️⃣ Complexity and Confusion

Insurance policies can include:

- Exclusions

- Riders

- Deductibles

- Waiting periods

The complexity overwhelms some buyers. Instead of seeking clarification, they avoid the purchase altogether.

7️⃣ Dependence on Employer Coverage

Some individuals rely solely on company-provided insurance and assume it is enough.

However:

- Employer coverage may be limited

- It may not cover family members

- It ends when employment ends

Relying only on workplace insurance can leave protection gaps.

8️⃣ Cultural and Social Factors

In some cultures, discussing death, illness, or financial risk is uncomfortable. This emotional barrier prevents conversations about life or health insurance.

Additionally, family support systems sometimes create a false belief that insurance is unnecessary.

9️⃣ Preference for Immediate Spending

People often prioritize visible purchases like:

- Gadgets

- Cars

- Vacations

Insurance, on the other hand, provides invisible protection. Since there is no immediate tangible benefit, it is often deprioritized.

The Risk of Avoiding Insurance

Avoiding insurance may save money in the short term, but it can lead to:

- Financial instability

- Loss of savings

- Debt accumulation

- Stress during emergencies

- Burden on family members

A single major medical emergency or accident can erase years of savings.

How to Overcome Insurance Hesitation

Here are practical steps to move forward:

✔ Start with basic coverage (health or term life)

✔ Compare policies carefully

✔ Read policy documents thoroughly

✔ Ask questions before buying

✔ Work with reputable insurers

✔ Review your coverage annually

Insurance is not about expecting something bad to happen — it’s about being financially prepared if it does.

Conclusion

People avoid buying insurance for many reasons — cost concerns, lack of awareness, mistrust, or simple procrastination. However, avoiding insurance doesn’t eliminate risk; it only shifts the financial burden entirely onto you.